- Crypto Solutions

- By business model

- By auction model

- Services

- Case studies

- Contact

The cryptocurrency market is showing strong resistance to the financial crisis. As of early November 2022, the global cryptocurrency market capitalization amounts to $0.94 trillion, and more businesses supplement their toolkits with digital money. According to CoinMarketCap, there are 526 exchanges whose daily trading volume exceeds $55 billion. The perspectives of this project may inspire your entrepreneurial self to build a crypto exchange. Impossible is nothing. Especially with reliable crypto exchange software and a sound plan to follow. Join in!

Why Start Your Own Crypto Exchange?

The potential of a public company can be evaluated by its historical profitability adjusted for future growth. It is not the case with crypto exchanges, as this business line is too young for such analyses. Despite that, you can estimate the potential of the crypto market and its players.

Let’s not forget that the crypto market is not merely about cryptocurrencies; it covers:

- Smart contracts

- Decentralised applications (dApps)

- Decentralised finance (DeFi)

- Non-fungible tokens (NFT)

Cryptography and blockchain are rapidly emerging industries capable of radically changing our lives in the upcoming decade. Analysts predict regardless of the current downslide, the crypto market will grow. Of course, the blockchain needs time to conquer the world. But the major income item, commissions, is projected to climb soon due to a gradual boost of users who utilise exchanges.

Basic Guidelines To Start a Cryptocurrency Exchange Business

When you decide to open an exchange, you should know what to use. Here is a step-by-step algorithm for how to build a cryptocurrency exchange:

-

- Make a business plan

- Choose a type of exchange

- Obtain a crypto licence

- Decide on a software provider

- Find a processing provider

- Negotiate with a liquidity provider

- Create a professional team

- Promote your project

Just like that. Only seven steps to setting off a new business environment. Yet, each with its specifics and peculiarities. Now in more detail about them.

8 Steps to Start a Cryptocurrency Exchange

Make business plan

The essence of a detailed plan can hardly be overestimated. It is an inalienable stage that many opt to disregard. Anyway, if you want to build a cryptocurrency exchange of the best quality, you have to roll up your sleeves and commence from ground zero. Using this checklist may help:

Checklist: My business plan

- Study my target market

- Review market dynamics

- Analyse my competitors

- Calculate project costs:

1. Capital expenditures (CapEx) that form the base of my business:

- Licence

- Software with services like hosting, maintenance

- Processing provider

- KYC provider

- Liquidity provider

2. Operating expenses (OpEx) that need to be allocated daily:

- Online marketing

- Research and development

- Equipment

You can find other guidelines and draft calculations for crypto projects on the web. Another option is to contact us for professional assistance. Read our guide: how do crypto exchanges make money?

Choose type of exchange

Generally speaking, there are two large groups of cryptocurrency exchanges: centralised and decentralised. On a centralized exchange platform (CEX), all transactions are governed by a third party, meaning deals are not concluded directly between traders. Besides, clients can trade money only after indicating their personal data required for KYC authentication.

Along with that, a decentralized exchange (DEX) is controlled by traders themselves, which allows them to operate peer-to-peer, that is to say, directly to or from their wallets. Such a website may be suitable for clients who do not want to share their data for some reason.

Even though independence is the very essence of blockchain technology, CEXs are more widespread, represented by the giants like Binance and Huobi. The core principle is the responsibility this business guarantees to clients, returning assets in case of cyberattacks. Through a different lens, the main peculiarities of decentralised exchanges, with the platforms like Uniswap and Balancer, are autonomy, low liquidity and less popular coins.

To create a crypto exchange platform, you should thoroughly analyse which model matches your goal most and decide whether you want it to be regulated or unregulated, with or without fiat currency, for spot and derivative trading, etc.

Obtain crypto licence

You can in no way put a blind eye to this milestone to start a resilient crypto exchange. As a relatively young phenomenon, the field of cryptocurrency and blockchain technologies is unevenly regulated. Jurisdictions introduce bills at their own pace, which leads to ambiguity or blank spaces in legislation.

And yet, the growing number of crypto platforms motivates governments to condition the industry. More than 100 countries elaborated a consistent set of laws to govern the crypto domain. Here are Estonia, Latvia, Lithuania, Poland, Germany, Georgia, Gibraltar, Malta, Singapore, Switzerland, the UAE, and so on. For more information about crypto-friendly jurisdictions, check this article on the Best Jurisdiction For Crypto Exchanges.

All in all, the jurisdiction for the cryptocurrency exchange you envision should coincide with your development strategies. One alternative way is to seek legal advice or choose a turnkey product with inbuilt legal support to ensure licencing requirements are met.

Open bank account

To legally run your own cryptocurrency trading platform and profit, after acquiring a licence, you will need to open a bank account to withdraw virtual currency. Documents and general requirements for opening an account vary in each country. Yet, the basic features are:

- KYC verification

- Identity authentication

- Licence check

- Confirmation of paying sources

Even in crypto-friendly states, like Malta or Singapore, there may be nuisances you may not be aware of as a non-resident. For a clean result, contact financial experts in this field.

Decide on software provider

How to start a cryptocurrency exchange with the least effort and cost? Instead of building software from scratch, you had better search for qualified developers to reduce launch time and minimise risks.

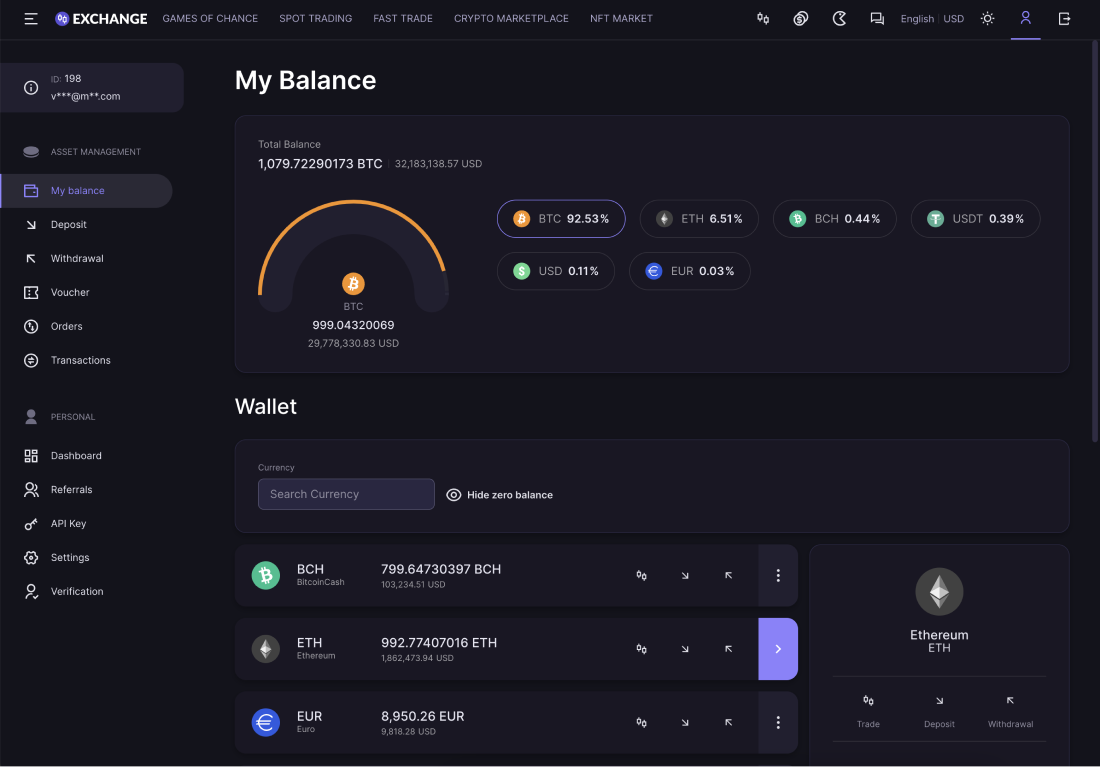

As to the performance, this system should be efficient and high-capacity. Its functionality should include a wide inventory for crypto trading, such as various currencies, indices, etc. There also should be:

- Reliable risk management tools

- Convenient admin panel

- User-friendly interface

- Flexible settings

- Real-time data analysis

Keep in mind that the overload of features may be a bad sign, since it is challenging to empower their simultaneous smooth operability, which will only result in mediocre general output.

Ensure infrastructure support and system resilience

A separate significative when choosing a developing company is the full-fledged customer support that will save you time on HR, product development and other work-related issues. You can rather focus on building your business and the following objectives.

The quality service providers of the Merkeleon level offer products that completely meet your needs and guarantee revenue on the liquidity margins. In addition, among others, these companies maintain:

- Technical support

- Integration

- Scaling

- Configuration

- Cloud hosting

- Troubleshooting

First of all, such full maintenance demonstrates that your provider is part of the game and cares about the result as much as you do. Secondly, you get quality guarantees because the developer accounts for their product. Last but not least, you avoid the extra burden of searching for maintenance specialists.

Protect your business

Security is another important characteristic to control. Crypto exchanges are notorious for a plethora of cyberattacks. While the exchange business attracts more investors and entrepreneurs, even more hackers look for ways to intrude. The issue can be tackled with a professional approach and strict adherence to current rules and regulations, which include KYC and identity verification.

Here comes Merkeleon. Launching our first cryptocurrency exchange in 2014, we pioneered the industry and, in 2018, became the first externally audited platform in the world. Our project was acquired by Bitfury, a security and infrastructure provider for the Bitcoin Blockchain. With our experience, you can minimise operational risks and expenses, plus optimise your cryptocurrency trading business.

To grant your users access to a safe website, check our article on How To Protect Your Crypto Exchange, where we discuss possible threats and how to combat them.

Find processing provider

In fiat processors, a payment service registers and transmits the required data, validates the login information and authorises the money transfer by issuing confirmation to the parties involved. A cryptocurrency trading engine operates similarly: it acts as an intermediary between a buyer and seller, sending transaction data to the blockchain and receiving confirmation from the node. To simplify the process for your clients, this gateway may exchange the currency, crypto to fiat and vice versa.

Checklist: How to choose the right processing provider?

- Emphasise their scope of activity. Some companies specialise in certain areas, for example, gambling or online stores, and may have little to no expertise with your case. Pick those specialists that meet your needs.

- Pay attention to the choice of currencies for users. Long past the time when businessmen wondered how to start a bitcoin exchange only. A minimal toolkit now should involve key players, like bitcoin, ether, litecoin, doge, tether, and a few minor ones.

- Protect your project. Review the provider’s previous records and request the scorecard of a third-party audit. It will indemnify your exchange website and the end user not only from hackers, but from system errors too.

Negotiate with liquidity provider

The liquidity indicator reflects the ability of an asset to be sold quickly with minimal loss in value due to the speed of sale. Among investors, the most popular pairs of assets are:

- BTC / EUR

- BTC / USD

- BTC / ETH

- ETH / EUR

- ETH / USD

In the traditional stock business, to provide liquidity market makers come into the picture. They enable it by making counter offers in response to traders’ orders. It seems they incur losses if they accept the offered price. Nevertheless, the method presupposes a small loss and pays off in the long run, driven by bigger volumes.

To create a crypto exchange that stands out among all others, attract several liquidity providers. It upscales the efficiency of financial transactions and cuts the risk of an undesirable shift in the order price.

Create professional team

Given the recent trends and the FTX collapse, we want to stress how vital it is to assemble a professional, reliable team. A wise approach to hiring processes results in competent internal financial reporting, restricted access to client funds, protected wallets whose assets cannot be traded upon and simple external audit.

For that, choose only tried and trusted specialists for key roles. Your CEO, CTO and CFO should not only have an extensive experience in the crypto field, but a clean reputation too.

Then, wisely organize departments, Treasury, Compliance, Bizdev, Security, Customer Care, Marketing. You can in no way disregard the importance of any team and its members who help you:

- Implement financial accounting standards

- Organize custody

- Set internal security policy

- Build compliant-friendly workflow

Yet, it might not be enough to recruit the best field specialists. The environment and management should be smart to guarantee productive work. Your crypto exchange can become a success only when you work together with a well-orchestrated team that has skin in the game.

Promote project

The profitability of your business directly correlates with investments in advertising and promotion. The core principle of a good PR campaign is knowing what your target audience needs. Based on this information, you can:

- Develop a marketing strategy

- Make content

- Work with partners (media, influencers)

- Advance existing technology

- Implement new features

Marketing tools are many: SEO, social media, event and video marketing, CRM, etc. If funds are sufficient, you can have a marketing team responsible for creating a catching image and building tactics for drawing in the public. Otherwise, you can turn to us and work with Merkeleon marketing specialists. We will gladly share working practices with you.

What About Cost to Build a Cryptocurrency Exchange?

A standard cloud exchange will pull on €300,000. For this money, you get:

- Infrastructure solution

- Minimum budget for liquidity in the order book

If you team up with liquidity providers through trading platforms, for instance Finery Markets, you diminish liquidity costs several times. It results from the site model, which is not storage related. Besides, traditional crypto exchanges usually demand a 100% investment to allow a liquidity balance for trading pairs. Having said that, Finery Markets requests only 20%, while the rest can be directed to development.

To plan your budget neatly, you must analyse liquidity indicators to assess the state of liabilities and assets, as well as prevent bankruptcy. More about it in our future articles.

Key Takeaways of a Cryptocurrency Exchange Business

To cut a long story short, before you buy any software, you need to make a plan and establish your audience, the model of your exchange, where you want to settle it, who will provide software and liquidity for your site and how you will promote it.

It is necessary to remember that a freshly born crypto-brand will not be able to out beat mastodons on the global exchange market within a few weeks. Well-chosen liquidity providers, along with investments in marketing and promotion, however, will quickly take your site to a solid level in the industry.

If this is your first project with cryptocurrencies, we recommend using the help of more experienced mentors who can direct you and give access to other experts in the field.