- Crypto Solutions

- By business model

- By auction model

- Services

- Case studies

- Contact

In some countries, digital money is prohibited, and legal instruments for its transactions work only in one direction. The regulation of cryptocurrency in selected jurisdictions, however, is forward-looking, and legal authorities are actively drafting comprehensive regulatory guidelines for users and businesses.

Crypto jurisdictions vary, and when launching a company, many questions arise, the major being what jurisdiction is the best for a crypto company? Not to make things more complicated and facilitate successful development, a business should think about crypto-friendly jurisdictions in advance. In this article, we are talking about crypto regulation in the EU countries.

What Is Cryptocurrency Jurisdiction?

The cryptocurrency jurisdiction determines the right to interpret and apply the law regarding crypto. Here come the categorization of digital money, the development of the industry, the legalization of businesses and so on. Since cryptocurrency is a relatively new phenomenon, legal mechanisms are not evenly elaborated in different localities. As of now, the best jurisdictions for crypto in the world are Estonia, the Czech Republic, the United Kingdom, Japan, the United States and a few other states.

Business Jurisdiction

Imagine your project is ICO-oriented, that is, you put your token for sale to raise capital. Depending on a token type and a sale model, your activity falls under the regulation of, say, the Securities and Exchange Commission (SEC). Then there may be troubles and lawsuits.

To keep your token away from the investment status, it must have the properties solely of a means of payment. It is worth to remark that if your business falls under the securities law, it does not mean a bar on a licence and a ban on a project. Yet, it can put bounds on your startup, prevent you to implement all the ideas and complicate the way to your targets.

To navigate these challenges and launch your crypto project successfully, consider utilizing a white label crypto wallet solution. The full package product includes legal assistance, meaning you do not waste time on researching legal frameworks and preparing documents. Our partners do it for you.

Key Features of European Crypto Regulation

Suppose you choose the European Union crypto regulation, because you plan to start your company here. The EU cryptocurrency regulation and crypto regulation in the countries of Europe may differ, as individual states supplement existing documents and complement them with more provisions.

EU Crypto Regulations

The EU regulations on cryptocurrencies include the following documents:

· Directive (EU) 2015/849 of the European Parliament and of the Council (4AMLD)

· Directive (EU) 2018/843 of the European Parliament and of the Council (5AMLD)

· Proposal for a Regulation of the European Parliament and of the Council, 2020/593 (MiCA)

Even though European states have common legislative framework, the union states have their own legislation regarding crypto. For example, the Czech Republic is called home for cryptocurrency supporters because the government adheres to digital money, while in Finland crypto is not considered an independent tool for payment. Now let’s move on to crypto-friendly European countries.

Best Crypto Jurisdictions in Europe

While the EU does not answer the question about the legality of mining, such states as Estonia, the Czech Republic, Lithuania and Poland have progressed significantly and are listed as crypto-friendly countries in Europe 2022. Not only mechanisms for regulating crypto transactions have been worked out here, but also algorithms for getting a business licence.

For instance, the Estonian crypto regulation is the most progressive in Europe. Here, due to the Money Laundering and Terrorist Financing Prevention Act (MLTFPA, 2017), you can run cryptocurrency business legally. Moreover, crypto itself is held as an additional means of payment.

Regulation in the Czech Republic also prompts the development of crypto companies in Europe. The Czech Republic was among the first in the world to draw up legal documents for cryptocurrencies. Individual crypto transactions are free from tax and are not subject to licensing. Besides, the National Bank urges other banks to harness cryptocurrencies.

Crypto licences in European countries

To choose the best jurisdiction for cryptocurrency business, answer these questions:

· What activities does the licence cover?

· Is there a local regulator?

· Is the commercial model profitable?

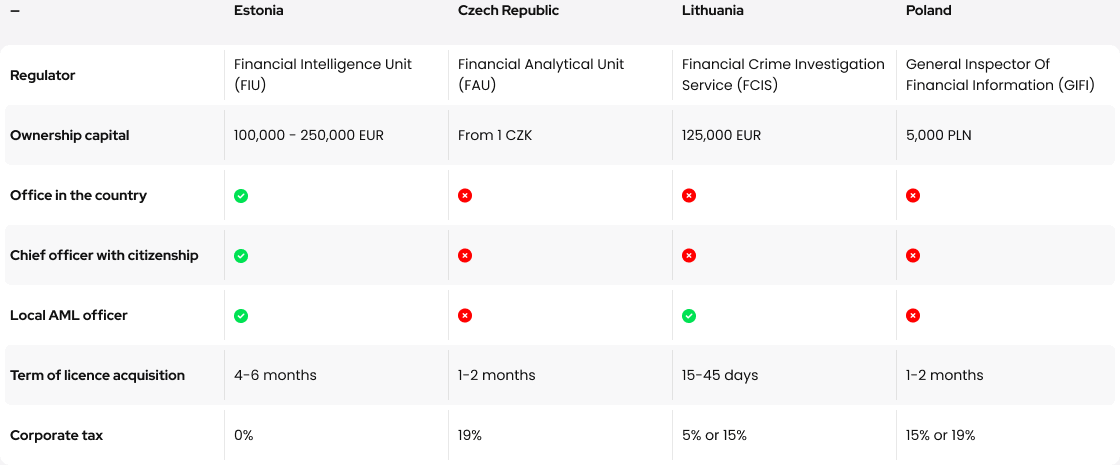

The time period within which you will be able to receive a licence relies on the legislation of a particular country, together with the extent you meet all the requirements. Following legal documents, we compiled a table of popular European states for crypto companies in July 2022.

Best jurisdiction for cryptocurrency exchange: EU crypto regulation

The data is provided by the partner company Eestifirma that supplies turnkey services for obtaining a licence.

Key Takeaways

Now that you have basic information about cryptocurrency regulation in the EU, you can pick the jurisdiction with the most suitable crypto regulation in Europe. What to do next?

1. Choose cryptocurrency exchange software, its features and add-ons.

2. Decide how to apply for a licence: independently or seek help from a specialized consulting company.

3. Study licensed companies, calculate whether the budget is sufficient for purchase and whether they go with your development policy.

4. Prepare documentation, according to the method of application, independently or with an expert company.

In the next article, we will analyse in detail legal provisions in individual countries and discuss their differences.

Read our article about KYC for crypto exchanges in 2023.