Crypto Margin Trading Software for Advanced Exchange

Unlock the power of crypto margin trading with Merkeleon solution. You can effortlessly start a crypto exchange with crypto margin trading inventory and give users access to a world of amplified trading potential. With our comprehensive instrument, you stay ahead of the competition.

Crypto margin trading allows you to amplify trading positions of your exchange. At Merkeleon, we understand the unique needs of crypto exchange operators. The functionality of crypto margin exchange generates additional revenue through trading fees and interest charges. You can enhance user engagement and retention with advanced trading features, attracting a broader user base and solidifying your platform’s reputation as a comprehensive trading solution.

Exchanges Launched Worldwide

Audited Cryptocurrency Exchange Software

Years of Crypto Exchange Development

Years in Software Development

Features of Margin Trading Exchanges

-

A separate margin user account

-

Limit, Market, Stop, OCO orders

-

Take profit (limit/market)

-

Stop loss (limit/market)

-

Long and Short positions

-

Up to 125X user balance leverage

-

Cross and isolated margin types

-

Customizable leverage options

What is Crypto Margin Trading?

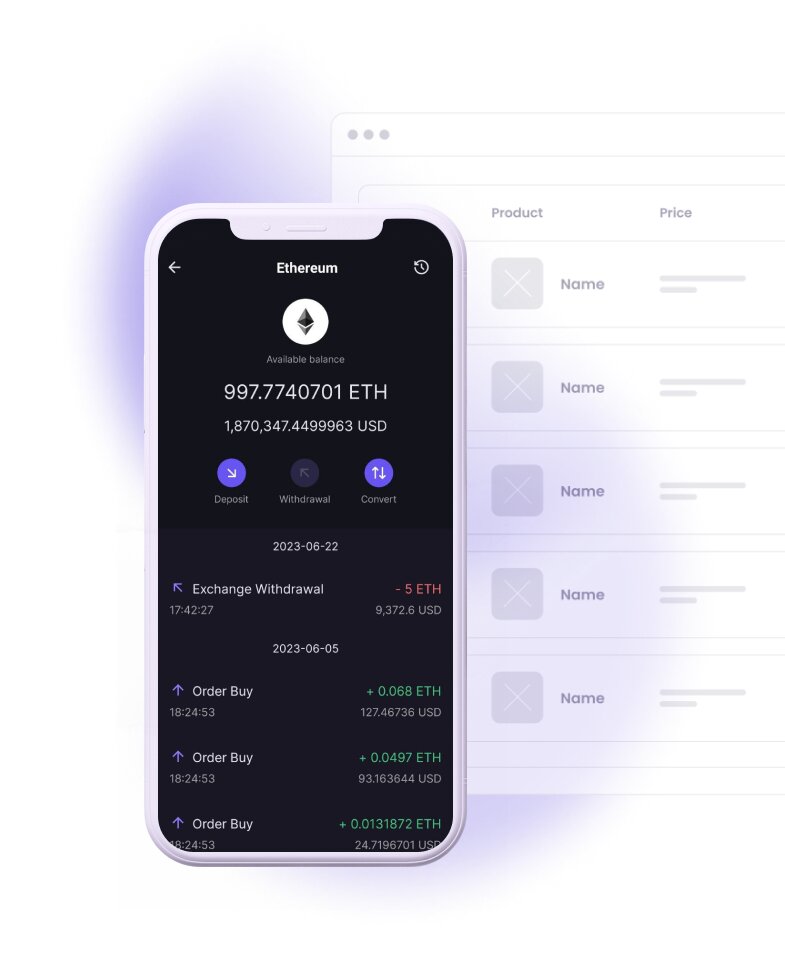

Crypto margin is a trading method that allows traders to borrow funds from a cryptocurrency exchange. As a result, users amplify buying power and increase potential profits, since traders open larger positions than their account balance would allow.

On margin trading exchanges, users employ leverage to enter trades with a fraction of the total trade value. Borrowed funds serve as collateral for the trade. Along with that, the trader must keep a certain margin or collateral amount in their account to cover potential losses. The margin is usually expressed as a ratio, 2x, 5x, or higher. This ratio indicates how much the trader can multiply their position size.

Margin trading is popular among experienced crypto traders who aim to take advantage of short-term price movements and volatility in the cryptocurrency market. It provides opportunities for traders to profit from rising and falling markets by opening long (buy) or short (sell) positions.

Benefits of Crypto Margin Trading

For traders

- Increased buying power: Margin trading allows traders to leverage their capital, meaning they can control larger trading positions with a relatively smaller amount of funds.

- Higher profits: With margin trading, traders are potent to generate higher profits compared to traditional spot trading. The ability to trade with borrowed funds allows traders to take advantage of short-term price fluctuations and capitalize on both upward and downward market movements.

- Diversification: Margin trading enables traders to access a broader range of trading instruments and markets. Instead of being limited to buying and holding assets, traders can enter short positions and profit from declining markets.

- Hedging: Margin trading provides traders with the ability to hedge existing positions in the spot market. By taking opposite positions in margin trades, traders can offset potential losses in their spot positions and minimize risks.

- Advanced trading features: Crypto margin trading exchanges provide a range of advanced trading tools and features. They include stop-loss orders, take-profit orders, trailing stops. Such tools can enhance trading precision and efficiency.

- Market Efficiency: By facilitating increased trading volumes, margin traders add depth to the order books and ensure smoother execution of trades. This liquidity can help reduce slippage and improve overall trading experiences for traders.

- Skill development: Margin trading requires traders to have a deeper understanding of market dynamics, risk management, technical analysis. Crypto margin trading can help to develop trading skills, gain market insights, improve decision-making abilities.

For operators

- Increased trading volume: Margin trading can increase trading volumes on crypto exchanges. Operators allow them to amplify trading positions and access larger markets. Higher trading volumes contribute to transactional revenue through trading fees and commissions.

- Competitive differentiation: In a competitive cryptocurrency market, offering margin trading can differentiate an operator’s platform from others. Margin trading is a sought-after feature among traders who desire more advanced trading options.

- Increased user engagement: Traders engaged in margin trading tend to spend more time on the platform, leading to increased user engagement and longer session times. This can contribute to higher user retention rates as traders develop a strong connection with the platform.

- Market depth and liquidity: Integrating margin trading into a platform can enhance market depth and liquidity. Margin traders add liquidity to order books, increasing the number of buy and sell orders available in the market. It improves trading experience, reduces slippage, increases the efficiency of orders.

- Risk management tools: Margin trading platforms often provide operators with robust risk management tools and features. These tools include margin requirements, liquidation mechanisms, risk monitoring systems. Operators can protect traders and the platform from excessive losses and maintain the integrity of the trading environment.

- Data insights: Margin trading generates valuable data and insights that operators can leverage for platform improvements. By analyzing trading patterns, user behavior, and market trends, operators can gain valuable insights into their users’ needs and preferences. This data-driven approach enables operators to optimize their platform’s performance, enhance user experience, and make informed business decisions.

How Does Crypto Margin Trading Work?

Crypto margin trading enables traders to trade with more funds than they actually possess, opening up opportunities for higher potential profits. Here's a step-by-step breakdown of how crypto margin trading works:

Crypto Margin Trading Modes We Offer

A crypto exchange operator who offers different margin trading modes can enhance their platform's appeal and attract a broader user base.

Isolated margin trading

-

What is it?

A mode that allows traders to open positions with leverage while maintaining independent risk management for each trade. The margin and collateral are segregated for each position, meaning that losses in one position do not impact the margin or collateral of other positions.

-

Key features

Individual risk management: Traders can set stop-loss orders and take-profit levels for each position separately, managing risk on a per-trade basis. Independent margin allocation: Each position has its own margin requirements and collateral, ensuring that losses in one position do not affect the margin available for other positions. Precise position control: Traders have greater control over the risk exposure of each trade, allowing for more granular risk management strategies

-

For who?

For traders who prefer a more focused and controlled approach to managing trades. They can set specific risk parameters and limit the impact of losses on their trading portfolio.

Cross-margin trading

-

What is it?

A mode where the margin and collateral are shared across all open positions. The entire account balance acts as collateral for all trades. Profits or losses from any position impact the overall margin available for other positions.

-

Key features

Shared margin and collateral: The margin and collateral are combined across all positions, maximizing the use of available funds. Increased position flexibility: Traders can maintain larger positions with lower margin requirements, as the entire account balance is considered collateral. Higher exposure to risk: As all positions share the same margin, losses in one position can impact the available margin for other positions, potentially leading to liquidation if not managed carefully

-

For who?

Cross margin trading is favored by traders who want to maximize their capital efficiency and take advantage of larger positions with lower margin requirements.

Other Trading Instruments from Merkeleon

Merkeleon offers other instruments that empower operators to provide users more trading options and enhance the overall experience on the platform.

Perpetual Swaps

Perpetual swaps are a type of derivative contract that allows traders to speculate on the price movements of underlying assets without an expiry date. Merkeleon offers perpetual swaps with a margin of USDT. Perpetual swaps offer an opportunity to participate in leveraged trading without the constraints of traditional futures contracts. This instrument caters to traders seeking to capitalize on short-term price fluctuations and maximize trading potential.

How to Use Perpetual Swaps?

Using perpetual swaps involves a series of steps and considerations that traders need to follow.

Benefits of Perpetual Swaps

For traders

- Continuous trading: Perpetual swaps offer continuous trading without the need to roll over or close positions. Traders can hold positions for as long as desired.

- Leverage and amplified profits: Perpetual swaps grant access to leverage, allowing traders to control larger positions with a smaller amount of capital.

- Short selling opportunities: Crypto perpetual swaps enable traders to take short positions, speculating on the price decline of the underlying cryptocurrency.

- No expiration date: Traders can hold positions indefinitely. They can decide when to close positions based on market conditions and trading objectives, without being constrained by contract durations.

- Hedging opportunities: Perpetual swaps allow hedging positions in the spot market. By taking opposite positions in perpetual swaps and spot markets, traders can mitigate the risk of adverse price movements.

- Access to multiple cryptocurrencies: Access to a wide range of cryptocurrencies enables traders to diversify portfolios and benefit from trading opportunities across different digital assets.

For operators

- Expanded trading offerings: By incorporating perpetual swaps into your platform, operators can expand their range of trading instruments and attract traders who want more advanced trading.

- Increased trading volume: Operators can increase trading volumes on their platform and generate higher transactional revenue through trading fees and commissions.

- Higher liquidity: Perpetual swaps have high liquidity due to their popularity among traders. Higher liquidity attracts more traders, fostering a vibrant trading environment and ensuring smooth trades with minimal slippage.

- Engaged user base: Traders who participate in perpetual swaps tend to be actively involved in monitoring market movements and executing trades. This engagement leads to increased user activity, longer session times and higher user retention rates.

- Revenue from funding payments: Operators can earn revenue by charging a small fee on funding payments. This additional revenue stream can contribute to the profitability of the platform.

- Risk management: Proper risk management measures, such as margin requirements and position liquidation protocols, help maintain the integrity of the platform and safeguard users’ funds.

- Market insights: Operators can gather information on trading volumes, user behavior and market trends to improve the platform’s performance, enhance user experience, make informed business decisions.

Why Choose Merkeleon?

-

Comprehensive software

Merkeleon offers a comprehensive software that supports a wide range of trading instruments, including crypto margin and perpetual swaps. By choosing Merkeleon, you can build a versatile and robust trading environment that caters to the needs of both novice and experienced traders.

-

Advanced trading tools

Merkeleon provides advanced trading tools and features that enhance your trading experience. You can take advantage of features such as real-time market data, advanced charting capabilities, technical analysis indicators, customizable trading interfaces. These tools empower your traders to make informed trading decisions and trade effectively.

-

Risk management features

Merkeleon emphasizes risk management and provides risk mitigation features to protect your users. These features include stop-loss orders, take-profit orders, margin maintenance alerts. By setting appropriate risk parameters and utilizing these tools, traders can actively manage and minimize potential losses.

-

Security and reliability

Merkeleon prioritizes the security and reliability of its trading platform. The software features robust security measures, including two-factor authentication (2FA), encryption protocols, secure storage of user funds. With Merkeleon, you can have confidence in the safety of your exchange.

-

Regulatory compliance

Merkeleon can help you adhere to regulatory standards and compliance requirements, ensuring that your exchange operates in a legal and regulated environment. This commitment to compliance instills trust and confidence in the platform, providing you with peace of mind while managing your business.

-

Continuous Innovation

Merkeleon stays at the forefront of technological advancements in the crypto trading industry. We continuously enhance our software and package solutions, introducing new features and improving user experience.

CONTACT FORM

CONTACT FORM

Contact Us

FAQ

What are the best platforms for crypto margin trading?

The cryptocurrency market offers several platforms for crypto margin trading, each with its own unique features and advantages:

Binance is one of the largest and most popular cryptocurrency exchanges globally. It offers a robust margin trading platform that supports a wide range of cryptocurrencies and provides high leverage options. Binance is known for its liquidity, competitive fees, and a user-friendly interface.

Bybit is a dedicated crypto derivatives trading platform that focuses on perpetual swaps and futures contracts. It offers leverage trading options with advanced trading features, including customizable trading interfaces, risk management tools, and a reliable matching engine. Bybit is known for its user-friendly interface and strong customer support.

BitMEX is a prominent crypto derivatives exchange that pioneered perpetual swaps and futures trading in the crypto industry. It offers high leverage options and advanced trading features. BitMEX is known for its robust trading engine and comprehensive risk management system, although it’s worth noting that it primarily caters to experienced traders.

Kraken is a well-established cryptocurrency exchange that provides margin trading services. It offers a range of cryptocurrencies for margin trading with varying leverage options. Kraken is known for its strong security measures, regulatory compliance, and reliable trading infrastructure.

Huobi is a leading cryptocurrency exchange that provides margin trading services. It offers various trading pairs and leverages options, catering to both novice and experienced traders. Huobi is known for its liquidity, comprehensive trading tools, and a robust security system.

It’s important to note that while these platforms are recognized for their crypto margin trading services, each platform has its own strengths, user base, regional availability. It’s advisable to conduct thorough research, consider factors such as security, liquidity, fees, leverage options, supported cryptocurrencies and user experience to understand which of them aligns with your business needs and preferences best.

How can I manage the risks associated with crypto margin trading

Implement robust risk management measures, including setting leverage limits, margin requirements, and margin call rules. Regularly monitor traders’ margin levels and enforce stop-loss orders to limit potential losses. Providing educational resources on risk management is also beneficial.

What are the regulatory considerations when offering crypto margin trading?

Crypto margin trading may fall under specific regulatory frameworks depending on your jurisdiction. Ensure compliance with applicable laws, such as KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements. Stay updated on regulatory changes and collaborate with legal experts to navigate compliance challenges.

Alternatively, you can contact Merkeleon compliance specialists, and they will guide you through all regulatory specifications.

How can I attract traders to my margin trading platform?

Offer a secure crypto wallet app, competitive leverage options, low trading fees and a diverse selection of cryptocurrencies for margin trading. Provide a user-friendly interface, advanced trading features, and reliable customer support. Implement strong security measures to build trust and confidence among traders.

What technological infrastructure is required to support crypto margin trading?

To support crypto margin trading, you need a robust trading engine capable of handling high volumes and low latency execution. Ensure scalability to accommodate increased trading activity. Implement risk management systems, real-time market data, and order matching algorithms to provide a seamless trading experience.

Why should I consider offering crypto perpetual swaps on my trading platform?

Offering crypto perpetual swaps can attract traders seeking leveraged trading opportunities and the ability to trade cryptocurrencies without worrying about contract expiration. It can increase trading volumes, liquidity, and revenue generation for your platform.

How can I ensure sufficient liquidity for crypto perpetual swaps on my platform?

To ensure liquidity, encourage market-making activities and incentivize liquidity providers. Implement a robust matching engine capable of handling high volumes. Consider partnering with liquidity providers or connecting to external liquidity sources to enhance liquidity for perpetual swap trading.

How can I differentiate my platform's crypto perpetual swaps from competitors’?

Differentiate your platform by offering competitive leverage options, a wide range of supported cryptocurrencies, and user-friendly trading interfaces. Provide advanced trading features such as stop-loss orders, take-profit orders, and order types to enhance the trading experience. Regularly engage with your community, provide educational resources, offer responsive customer support to build trust and loyalty among traders.