- Crypto Solutions

- By business model

- By auction model

- Services

- Case studies

- Contact

Everyone plunging into the realm of virtual currencies needs to pick the best crypto exchange in the UK. They all, however, vary in functionality and quality. On some, you will find advanced security settings, but a small range of currency pairs. Others, provide user-friendly interface, but no fiat. So what crypto exchange to choose in the UK in 2023?

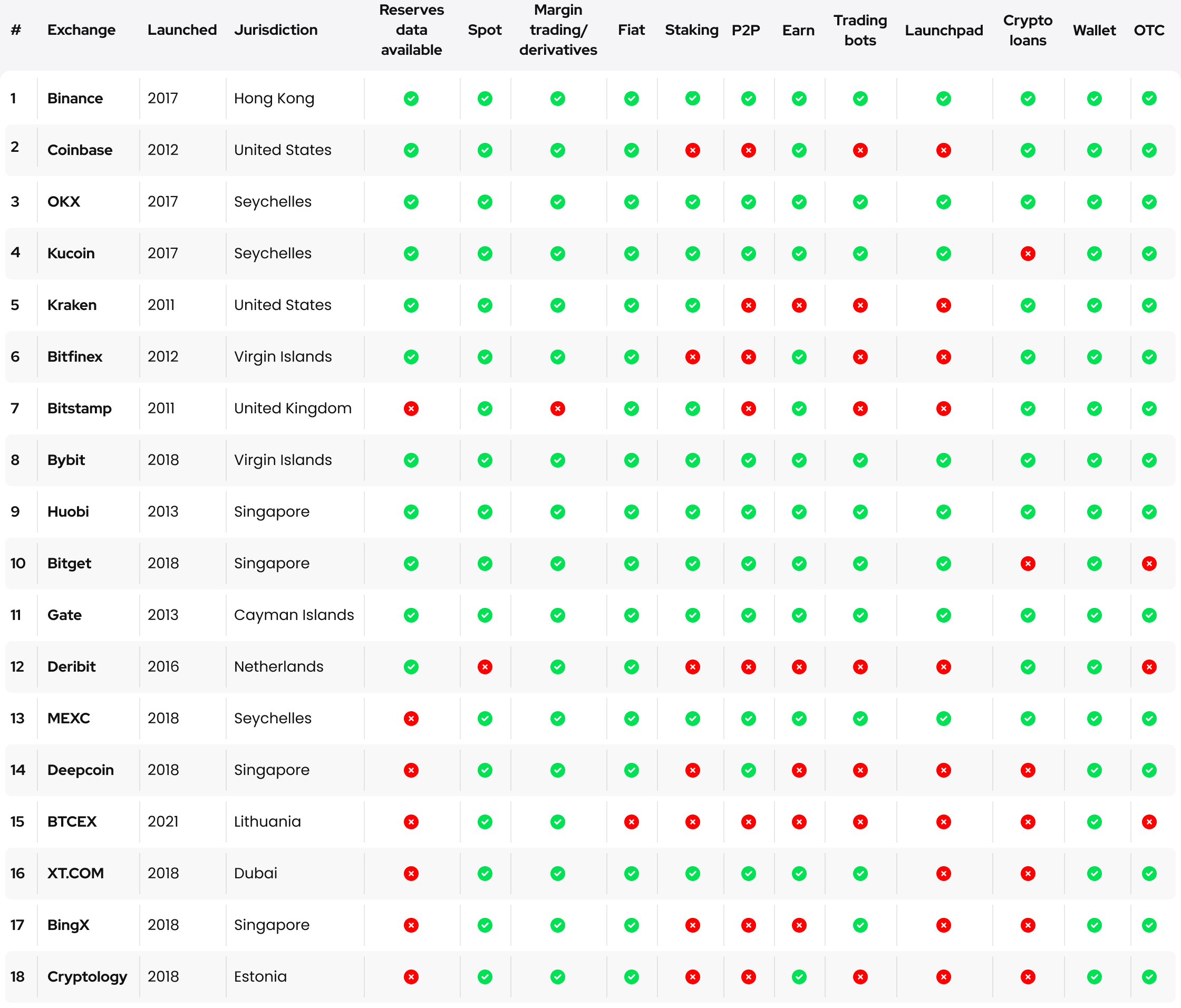

We have prepared a rating where 18 platforms are represented. To compose this list we selected top centralized exchanges in the UK published by 3 popular crypto analyst services: Coinmarketcap, Coingecko, Cryptorank. All the data is of January 27, 2023.

Best UK Cryptocurrency Exchanges Overview

As you can see in this table, Binance established in 2017 remains the industry leader. It is the foremost crypto domain in terms of average spot and derivatives daily trading volume; more than 1,600 markets are in place for trading. In addition, this platform has a reserve fund in the amount of $1 billion to cover unforeseen risks.

Binance is equipped with all modern trading functionality, which is in great demand among customers (crypto loans, margin trading, staking, P2P transactions, liquidity swap, etc.). Still, the functionality set is not a decisive factor, as domains with different suites of trading tools have made it to our top. Binance, above all, attracts customers with low commissions, weekly attendance figures demonstrate.

Best Exchange For Crypto Trends

Year 2022 introduced many modifications to the past patterns of crypto environments. Recalling recent hot news about the FTX collapse, many exchanges are now confirming reserves publicly. There are only 7 platforms in this top that have not provided official data yet: Bitstamp, MEXC, Deepcoin, BTCEX, XT.COM, BingX, Cryptology. Let’s move to other trends.

New jurisdictions

We should note that along with giants like Coinbase, Kraken, Bitfinex, Bitstamp that came in the 2010s, young and dynamically evolving sites are included in our rating. Even though the best positions belong mainly to crypto exchanges from Asia and USA, Arab Emirates and Baltic States jurisdictions are gaining momentum: BTCEX, XT.COM, Cryptology.

P2P trading

Another trend of 2022 anticipating the flow of 2023 is P2P trading being introduced into the existing functionality of crypto exchanges. Only 8 platforms in our top have not yet installed this feature:

- Coinbase,

- Kraken,

- Bitfinex,

- Bitstamp,

- Deribit,

- BTCEX,

- BingX,

- Cryptology.

P2P trading is a remarkable phenomenon that brings exchanges back to their essence: direct transactions with no intermediaries. We will talk about its specifics a bit later.

Modest functionality

What is more, our rating contains sites without an extensive functionality and popular modules, for example, exchanges such as BTCEX and Cryptology have only spot and margin trading tools, plus a wallet. Nevertheless, they perform well and make it to our list together with bigger and more trusted exchanges. On top of that, some major destinations like Bitstamp and Coinbase do not have derivatives trading available to everyone. Yet, these sites are in high demand among customers.

Other tendencies

In derivatives trading, it is worth mentioning Bybit and Bitget that have made it to our top-10 and now stand closer to industry stars, like Coinbase, Kraken, OKX, etc.

Apart from that, more and more domains introduce means for passive income. Now users can earn on front-rank crypto exchanges, excluding Kraken, Deribit, Deepcoin, BTCEX, BingX.

Facilitated by reduced volatility in the market, trading bots are also becoming more typical. These days they are available on Binance, OKX, Kucoin, Bybit, Huobi, Bitget, Gate, MEXC, XT.COM, BingX.

How To Choose Best Exchanges For Crypto in the UK?

For accomplished trading, among a wide choice online you must select quality platforms. To pick an exchange where crypto trading is sure to bring the best experience, it is vital you focus on:

- Daily trading volume. It points the degree of activity on a site. Beyond that, it aids to track demand for a particular coin; higher numbers ensure greater earning prospects for users. An exchange with a daily trading volume of 500,000 USDT, is unlikely to provide a lucrative profit. A big daily turnover, contrarily, reveals platform’s success, popularity, and influence;

- Reliability and reputation. Better reviews about an exchange on headline crypto forums, such as Bitcointalk or Reddit, implicitly contribute to your reliance on a crypto site. Avoid transferring money on suspicious exchanges that have negative feedback;

- User verification. On different exchanges, requirements for user verification diverge: some providers set strict rules and severely limit trading opportunities for those without verification; others instead are loyal to unverified users, but restrict withdrawals. There are also domains without mandatory identification and clients can stay anonymous;

- Selection of currency pairs. On individual trading platforms, traders can work with a narrow set of currencies. Some specialize only in bitcoin; yet, multiple currency pairs facilitate more tools for earning. Accessible currency pairs can be highly liquid currencies and less known emerging ones;

- Trading fees. All crypto exchanges charge service fees. Most environments do not set a constant sum, but make it dynamic. Larger fees reduce trading volume;

- Payment options. A wide set of payment mechanisms gives more means for transactions with digital assets. Many exchanges work exclusively with crypto and, while others allow fiat too;

- Convenient interface. Environments with more convenient tools for analysing data perform better regarding user experience; it enables fast and efficient trading processes. Instruments like charts and graphics help to correctly assess the market situation;

- Exchange geography. Some sites operate on the territory of one state, but are closed to users from other localities. Most often these are Japanese and South Korean exchanges, very attractive for cryptocurrency transactions, yet open only to residents of these countries;

- Course monitoring. Experienced investors register on several exchanges to find the most favourable trading conditions and earn from arbitration;

- Auxiliary software. In rare cases provers may ask you to install extra software for efficient operation online. There is no need to download additional programs to operate on trustworthy sites;

- Transactions and withdrawals. Before registering, you should study conditions for depositing and withdrawing, plus clarify which payment instruments this service supports, its restrictions and fees.

Other significant factors to clap your eyes on so as to find the best crypto exchanges are proof-of-reserves, security guarantees, and customer service.

What Crypto Exchange Models Are There?

Cryptocurrency exchanges can be differentiated by various factors. Conventionally, they are divided into centralized (CEX) and decentralized (DEX) services. And yet, there are more attributes crypto exchanges are distinguished with:

- Centralized or decentralized;

- Regulated or unregulated;

- With or without verification;

- With or without fiat;

- Spot, futures, p2p.

These categories can be more. Here we discuss the key ones. Let’s go for a detailed review of these crypto exchanges, with the examples of the best platforms from our list.

Centralized or decentralized exchanges

In the very beginning we have mentioned that the best crypto exchanges in our list are centralized. Centralized crypto exchanges are organized in a way similar to traditional stock exchanges: they are protected by laws and managed by specific legal entities responsible for flawless platform operation.

In this regard, the administration of a CEX has access to customer funds and, if necessary, can block an individual trader, a specific operation or an entire functionality, for instance, withdrawals. Furthermore, new users must verify their identity during the KYC stage.

Such a high representation of trustworthy CEXs over DEXs occurs due to the popularity of protected crypto destinations that guarantee funds integrity and compensation, plus legal defense in case of cyberattacks.

Regulated or unregulated exchanges

Regulated exchanges have all necessary licences to operate and fully comply with financial legislation of a certain jurisdiction. One of the requirements is to provide information about each client, so users who trade in such destinations have to give up their anonymity.

Nevertheless, it is not bad at all. For comparison, on unregulated crypto sites, users can stay completely anonymous, yet, in case of money loss, it will be almost impossible to ask for customer support and return funds.

As a result, the best crypto exchanges are governed and provide guarantees for clients. Limits and regulatory frameworks are described in legal documents elaborated to control digital currencies. Exchanges in our table are legalized under the norms of:

- UK,

- USA,

- Hong Kong,

- Singapore,

- Seychelles,

- Virgin Islands,

- Cayman Islands,

- Dubai,

- Netherlands,

- Lithuania,

- Estonia.

Regulated sites frequently undergo audits, which eliminates fake trading volume. Besides, only reliable and thoroughly tested coin developers can partake in listing. Additionally, users must pass KYC and AML identity verification, that makes it infeasible to register several accounts or enter false data.

Exchanges with or without verification

Crypto exchanges without verification allow us to trade and exchange the best digital assets for merely registering, without verification procedure, KYC and AML. While a plethora of upmarket sites demands identity verification, some platforms loosen this requirements. Among such platforms are:

- Bybit,

- OKX (stipulates verification for withdrawal),

- Huobi,

- MEXC (stipulates verification for withdrawals),

- Bitget.

To eliminate financial crimes and terrorism, governments subject companies to verify their clients. This pressure has triggered many regulatory rules to be implemented: methods for determining customer identity (KYC) and anti-money laundering directives (AML).

Legislation may vary in different regions, but the basic instructions remain. Any international business must comply with the KYC standards of jurisdictions it works with. Several trading platforms relief these rules, forcing only clients with large transfers to undergo verification. Consequently, the essential idea of the best cryptocurrency exchange to provide anonymity is preserved.

Exchanges with or without fiat

A fiat cryptocurrency exchange is the best platform for depositing and withdrawing money using traditional currencies: USD, EUR, CAD, TRY, etc. Usually this method is implemented through payment systems Yumani, Qiwi, Advcash, Payeer, Perfect Money or Visa/Mastercard debit cards.

In our rating, every exchange does accept fiat for transactions, except for BTCEX. It means if you trade on this site, you can swap cryptocurrencies only, plus import and export them.

Exchanges for spot, futures, P2P trading

Discussing trends, we have mentioned that the best exchange for crypto does not necessarily possess a wide inventory. Now, in more detail about the most essential functionality that determines a success of a platform.

Spot trading exchanges

On crypto exchanges with spot trading, assets are purchased immediately from one market participant to another at a price currently considered market (spot). The price of a currency lies solely on supply and demand, thus extremely volatile. After all, spot trading is possible only if both parties have assets necessarily for a transaction.

Spot trading is a common feature easily found on any of the best crypto exchanges. The only exception makes a Dutch domain Deribit that does not provide spot inventory.

Futures trading exchanges

Futures trading lets you trade a currency in the future at a value agreed at a particular moment. Futures prices are formed from spot prices, meaning transactions are happen directly between a buyer and seller. Simultaneously, risks are minimal, since for trading futures, a collateral is required.

In the futures market, crypto exchange rate is changeable, what puts speculators in the best position. Holding from price direction, funds are either taken from or added to an account. A huge advantage of futures contracts is leverage exchanges provide, thereby allowing to earn more. As to this feature among the platforms of our rating, futures functionality is not available on Bitstamp.

P2P trading exchanges

A P2P trading platform ensures a direct exchange of assets between market participants. It is the oldest forms to buy and sell cryptocurrency. The scheme works as follows: a user publishes an offer specifying terms for buying or selling virtual currencies (price, payment options, limits, etc.). Then anyone willing to conclude a deal, offers back. And a P2P transaction takes place.

Classic cryptocurrency exchanges are involved in operations, setting the terms of each transaction, for instance, fee structure. Whereas P2P only guarantees transparency and fairness.

As P2P transfers are going more public, many of the best exchanges allow to directly buy and sell cryptocurrency. However, it is not available on Coinbase, Kraken, Bitfinex, Bitstamp, Deribit, BTCEX, BingX, Cryptology.

Best Crypto Exchange For Beginners in the UK

Despite the fact that virtual currencies have been around for 13 years, with bitcoin initiating the trend in 2009, for many investors it is still a complex and unexplored phenomenon. To give people an opportunity to join it with no sweat, many domains are equipped with demo accounts.

An exchange demo account is used for trading unreal crypto and getting the best experience while learning. This option for beginners is available on Bybit.

What can beginners gain from a demo account?

- They get an accurate idea of how the crypto market works and how it reacts;

- They check trading strategies and make their own to later implement in real-life situations;

- They determine suitable cryptocurrencies for a particular trading style or strategy;

- They test the functionality of a specific exchange.

Meanwhile, some sites are generally novice-friendly, notwithstanding that all transactions are real there. Such platforms have basic inventory, comprehensive interface, and fiat gateways. These are Binance, Bybit, OKX, KuCoin, and MEXC.

What Are The Best Crypto Exchanges in the UK Without Verification?

Exchanges without verification do not request KYC verification, an international standard for identification. On the one hand, the KYC system provides security to a service and protects your account from theft. From the client’s point of view, though, verification deprives them of the blockchain principal advantage — anonymity.

In combination with KYC, the term AML or anti-money laundering is often used and refers to the fight against money laundering. AML tactics imply links between governments, legislative bodies, law enforcement, judicial authorities, and cryptocurrency exchanges.

Pretty many exchanges require that you go through full verification when you register there for the first time. Others, to the contrary, may demand your identity data when transacting large sums of fiat or cryptocurrencies. Some sites prefer optional verification: clients can complete first level verification, as well as not verify at all. Here come Bybit, OKX, Huobi, MEXC.

Best Crypto Exchange For Margin Trading

During margin trading, a trader receives extra money from an exchange, secured by the funds this trader has. Leverage indicates how much you can borrow. For example, if you have $100 and the leverage is 1:10, it means that you can use 10 times more money, $1000.

Margin trading is venturesome on stock markets; even more so in cryptoc domains. For this reason, this manoeuvre is unfitted for novice players, because as much as experienced traders incur losses.

Not all crypto exchanges offer margin trading. Basically, leverage is employed for trading futures. The only exchange from our rating that does not ensure margin trading is Bitstamp.

Best Cryptocurrency Exchange Platform With Lowest Commission

Commission fees make the lion’s share of exchange’s income, other than listing fees, broker services, and so on. Each particular site sets their prices for the services they provide. Anyway, there are 3 fundamental types of commissions on crypto exchanges:

- For depositing

Depositing virtual currencies is usually free. That said, fiat deposits can consume 5% of the amount. The exact sum depends not only on the exchange, but on the payment system or bank as well.

- For withdrawing

This type of commissions is present for cryptocurrencies and fiat. In the case of cryptocurrencies, its size is usually fixed and covers the transaction fee of a blockchain and provides profit to an exchange. Just like with depositing, fiat withdrawal fees may be 5% as they depend on the payment system.

- For trading (as a rule, buyer and seller commissions differ)

An integral expense item is the fee charged for an operation. Commissions above 0.25% are considered high. Fierce competition makes companies reduce fees to minimum, as well as to let you cut them later. Although one of the best US crypto exchange sites, Gemini consumes from 0.99% of the amount.

As said above, providers are free to decide on the commission sum. But then again, high commissions result in low popularity of a platform. In our rating, the lowest commissions go to Binance, Bybit, OKX, MEXC, Huobi, KuCoin, Gate, Bitget.

How To Trade On Crypto Exchange?

Professional traders call trading art. Fair enough, it cannot be mastered after reading tons of theoretical information. This skill is honed with practice when a trader can elaborate their own strategy and tactics for concluding winning operations. Yet still, there are a couple of fundamentals to stick to:

- Conduct every transaction in a calm mood, without succumbing to unnecessary emotions. Excitement and greed are trader’s enemies;

- Do not wait for an already increased rate to rise more. Especially, if the forecast predicts a fall. It is important to sell coins before their value drops;

- Regularly monitor quotations because this is the main source of data on any exchange;

- Be patient while expecting the signals for buying or selling. Crypto trading is risky, and impulsion can cause losses;

- Keep your assets in various coins and tokens, with some in bitcoin, since it owns almost half of the cryptocurrency market;

- Leave some assets in fiat currency. Even during a plunge, you can purchase virtual currencies at a low price;

- Do not keep large amounts on an exchange account. If you buy crypto for long-term, it is better to withdraw it to a wallet, better a cold one that has no permanent acces to online.

Among other things, it will not be superfluous to control the capitalization and volumes of cryptocurrencies on the market. These data allows you to make an approximate forecast of the course direction.

Key Takeaways

Based on the current statistics, Binance is still a leading exchange in the derivatives market, with regard to the range of derivatives and supported currencies. Although its market share is eroded by many other derivatives exchanges.

In summary, we want to note that new trends break into the crypto market every year. These days, futures have undoubtedly been one of the trends, and other perpetual swap instruments are currently trading on average 10 times larger than the base spot crypto market. It implies that a new crypto exchange platform offering derivatives trading can outperform the best sites by trading volume.

List of The Best Crypto Exchanges UK

1. Binance

Daily trading volume: $22,593,263,619

Currency pairs: 1389

Coins: 353

2. Coinbase

Daily trading volume: $1,558,065,058

Currency pairs: 552

Coins: 238

3. OKX

Daily trading volume: $1,780,649,145

Currency pairs: 654

Coins: 358

4. KuCoin

Daily trading volume: $822,292,220

Currency pairs: 1187

Coins: 721

5. Kraken

Daily trading volume: $732,450,743

Currency pairs: 668

Coins: 215

6. Bitfinex

Daily trading volume: $199,174,715

Currency pairs: 442

Coins: 184

7. Bitstamp

Daily trading volume: $154,970,877

Currency pairs: 163

Coins: 73

8. Bybit

Daily trading volumee: $430,174,087

Currency pairs: 358

Coins: 278

9. Huobi

Daily trading volume: $360,503,159

Currency pairs: 866

Coins: 608

10. Bitget

Daily trading volume: $720,262,080

Currency pairs: 452

Coins: 394

11. Gate

Daily trading volume: $513,068,431

Currency pairs: 2782

Coins: 1551

12. Deribit

Daily trading volume: $752,342,052

Currency pairs: 58

Coins: 46

13. MEXC

Daily trading volume: $1,790,084,800

Currency pairs: 2132

Coins: 1521

14. Deepcoin

Daily trading volume: $635,914,903

Currency pairs: 216

Coins: 83

15. BTCEX

Daily trading volume: $518,302,581

Currency pairs: 144

Coins: 137

16. XT.COM

Daily trading volume: $811,403,966

Currency pairs: 982

Coins: 602

17. BingX

Daily trading volume: $712,804,947

Currency pairs: 377

Coins: 366

18. Cryptology

Daily trading volume: $54,274,269

Currency pairs: 79

Coins: 44